$270 Billion Jet Deliveries Anticipated in Next Decade

According to the Jetnet iQ forecast, light jets are expected to account for more than 1 in 5 business jets produced from 2023 to 2032 with large-cabin aircraft a close second.

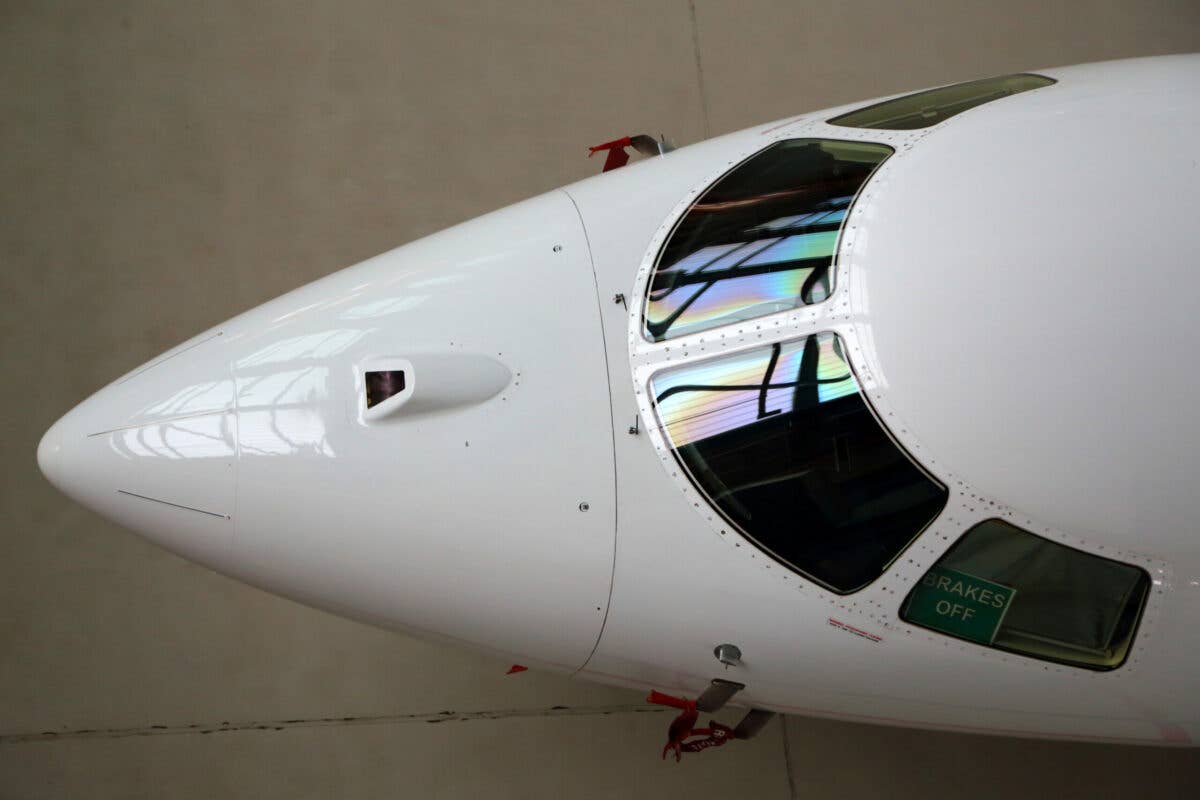

[Shutterstock]

Rolland Vincent, creator of the Jetnet iQ forecast, predicts business jet manufacturers will deliver nearly 8,700 airplanes worth $268 billion from 2023 to 2032. Light jets will account for more than 1 in 5 of those produced, the largest slice of the market by numbers.

Ultralong-range, large-cabin aircraft run a close second in delivery quantities, but score more than 60 percent of the sales revenue. The five largest purpose-built business jet manufacturers now have 18 to 24 month backlogs, says Vincent. Gulfstream, Bombardier, and Dassault have $40 billion in total orders, 80 percent of the first half of 2023 market.

Textron Aviation comes in fourth with a $6.8-billion backlog. Embraer trails in fifth place, but Vincent notes his data does not include NetJet’s order for up to 250 3,200 nm range Praetor 500 jets worth more than $5 billion. NetJets says that the Embraer Phenom 300 is its top requested light jet, helping to bolster Embraer’s order backlog.

Vincent says that iQ produces “independent, quarterly” research. Four to five hundred owner-operators are contacted four times per year to ask about operations, mood, and purchase intentions. Currently, 55.9 percent of those surveyed believe the market has passed its low point, clearly reflected in the “white hot” demand for business aircraft in 2021 and 2022.

A soft market correction is in progress. Used aircraft retail transactions have declined to about 2,500, and there are nearly 1,500 pre-owned aircraft on the market in 2023. Aircraft inventories are beginning to correct to historically normal 6.6 percent of the fleet for sale on the used market. But pricing remains strong, notes Paul Carderelli, Jetnet iQ’s sales vice president.

Vincent believes that taxes, regulation, risk, and border violence in Ukraine, Israel, and possibly Taiwan could be major factors in the future health of the business aviation industry. Operators gradually are becoming more optimistic, and the outlook for 2023 and 2024 is positive. He’s ruled out the risk of a major recession in the U.S. because of strong employment numbers and other indicators, but says that Europe, owing mainly to the economic downturn in Germany, is in a slight recession.

Business aviation’s main challenges are to create a “sustainable future,” reconstruct “talent pipelines,” improve the “industry’s image,” and adapt to requirements of younger buyers who like the mobility provided by business aircraft but don’t necessarily want to own and operate them.

A large majority of Jetnet iQ respondents believe that the benefits of business aviation are not well understood by the general public and new entrants into the market will have different requirements and priorities than those over 45 years of age.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox